The Ultimate Accounting Checklist For Creators

Fill in the blank: Accounting is _______________.

We’re guessing some of your answers might be:

- Boring

- Confusing

- Hard

- Not fun

As a creator, you’re probably either terrified of or have zero interest in accounting. We get it.

But a successful business needs good accounting. Beyond tax time and getting maximum tax breaks, accounting is a year-round activity.

And to help you on your accounting journey, we’ll walk you through the ten must-do steps your business needs to reach new heights.

Following this accounting checklist will help you feel more confident and more in control of your business finances.

Daily tasks

-

Track your time

Since your time is your money, keeping track of how you use it is critical for your financial success.

Although this isn’t a traditional accounting or bookkeeping task, keeping track of your time is essential for creators who charge clients for their creative skills. You’ll want to make sure you’re generating a profit, and you won’t know that unless you know how much time it takes you to create your client deliverables.

Keeping track of your time can take many different forms, including:

- Writing time down in a calendar

- Using a time tracking app

- Logging time into your CRM or project management systems

Regardless of how you keep track of your time, be consistent. You’ll eventually start seeing patterns that you can use to make future pricing decisions. For example, if you’re a writer, you may figure out that it takes you an hour to write 500 words. Now, you can easily quote projects.

Weekly tasks

-

Pay your vendors and suppliers

It’s best to get into the habit of paying your vendors each week. Treat your fellow business owners the same way you would want to be treated. Use the same day each week, so it’s easy to remember.

And set aside funds to ensure your vendors are paid on time to avoid paying late fees or interest.

Some suppliers may offer a prompt payment discount that lets you take a discount when you pay your invoice within 15 or 20 days.

-

Record your financial transactions

Keeping your financial house in order is the #1 priority to maximize tax benefits for your business.

You can choose to record all your revenue together unless you have multiple sources of revenue. Then you may want to track it separately.

But you’ll want to record your business expenses in categories like office supplies, computer software, and advertising. This will help when it comes time to file your taxes, and it’ll help you keep an eye on where your money goes.

If you aren’t already using bookkeeping software like Xero, Quickbooks Online, or Freshbooks, consider investing. For a small monthly fee, you’ll be able to simplify your financial recordkeeping in one spot by being able to:

- Invoice clients

- Pay bills

- Record expenses

- Prepare financial statements and reports

- Pay employees, if applicable

Monthly tasks

-

Send invoices to clients

Getting paid is the name of the game. So you should be sending invoices to your clients at least once a month. Depending on your business and clients, you may need to send them more frequently.

If you’re not using a bookkeeping software that has invoicing built into it, be sure to use an invoice template that includes standard things like:

- Itemized charges with descriptions

- Due dates

- Payment terms

- Payment methods you accept

And most importantly, have a tracking system so you know who’s paid you so you can follow up on outstanding invoices.

-

Reconcile bank accounts

After you’ve entered all your financial transactions, you’ll want to reconcile your bank accounts, including business credit cards, if you have any.

You may be familiar with doing this for your personal checking account. If so, you’ll use the same process for your business accounts.

If you’re not familiar with bank reconciliation, don’t worry. It’s not complicated.

You’ll just compare the transactions you recorded in your accounting software with the transactions shown on your bank statement. If there are any differences, they’ll likely resolve themselves on the next month’s reconciliation.

And if they don’t, that means you’ve probably made a mistake and you’ll need to do a bit of research to sort it out.

-

Review financial statements and reports

This is where having accounting software pays off. After you’ve entered all of your revenue and expenses for the month, you can create financial statements.

Financial statements are the official accounting term for financial reports. The two most useful financial statements for small businesses are:

- Balance sheet

- An income statement also called the profit and loss statement

Reviewing these reports each month lets you know how healthy your business is. You’ll be able to see how much money you’ve made, how much your clients owe you, and if you’re spending too much money on office supplies.

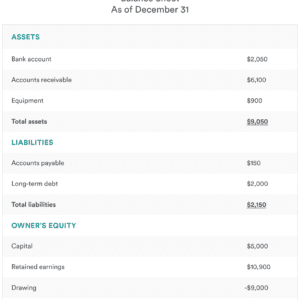

Here’s an example of what a balance sheet for a small business might look like.

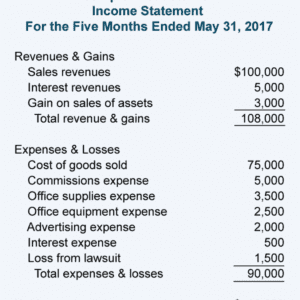

Here’s an example of what an income statement might look like for a small business.

Quarterly tasks

-

Make estimated tax payments

The U.S. uses a pay-as-you-earn tax system. This means that as a business owner, you’ll need to make estimated tax payments each calendar quarter.

If you don’t work with a CPA or tax preparer, you’ll need to look at your income statement to get a rough estimate of your net income to figure out how much to pay.

The IRS has specific criteria for how much tax you need to pay to avoid underpayment penalties and a good rule of thumb is to pay 25% of your net income.

Keep in mind that you’ll need to make estimated payments to the state if you live in a state with an income tax.

-

Pay sales tax, if applicable

If you’re selling a product or service that’s taxable in your state, you’ll likely need to send the sales tax you collect to your state each quarter. But your state may require monthly payments. So check with your state to find out when and how to make payments.

Annual tasks

-

Prepare and send annual tax forms like Form 1099-NEC

You may have received Form 1099 in the past from clients you worked with. And as a business owner, you’re responsible for sending 1099s to vendors.

Who gets a Form 1099-NEC, Nonemployee Compensation? Generally, if in a year you paid someone:

- At least $600 for services in the course of running your business

you’ll need to provide them with a Form 1099-NEC by January 31 for the previous year.

-

Prepare and file your annual tax return

We all dread that time of year–tax time. Depending on the tax structure of your business, your tax deadline may be March 15 or April 15.

| Federal tax return deadlines | |

| Business type | Deadline |

| Sole proprietorship | April 15 |

| Partnership | March 15 |

| S-corporation | March 15 |

| Single-member LLC | April 15 |

And if you live in a state with an income tax, you’ll need to file your state tax return too. Check with your state’s Department of Revenue for filing deadlines.

After your annual tax return is filed, archive your financial records and hang on to them for at least three years.

The accounting checklist for creators

Daily tasks:

- Track your time

Weekly tasks:

- Pay bills

- Record financial transactions

Monthly tasks:

- Invoice clients

- Reconcile bank accounts

- Review financial statements

Quarterly tasks:

- Make estimated tax payments

- Pay sales tax, if applicable

Annual tasks:

- File income tax returns

- Prepare and send Form 1099-NEC