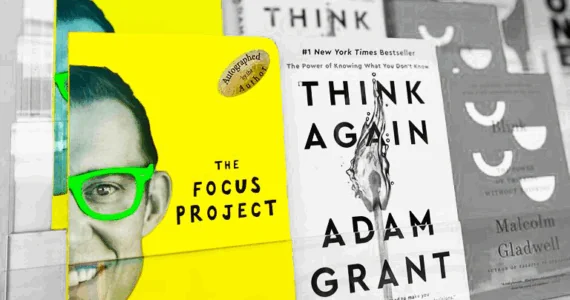

If this is your first time visiting Socialnomics.net, then “Welcome!” One of the first things you will want to do is click on “About” and learn who Erik Qualman is! You will also want to check out his books, and especially, “Socialnomics” (look to your right to click on the convenient links).

From the word, it sounds like it is about the economy and about economics, but Mr. Qualman takes it to a new, unique level (hence his celebrity status!) with the economics of people, the social aspect >> social-nomics. To quote Mr. Qualman, from his book, “It’s about the economy… No, it’s about a people-driven economy… Whether you are a businessperson or a high school student, social media transforms the way you live and do business” (Socialnomics, Kindle Locations 7041-7042).

So, why am I talking about money and investment strategy? For one reason, because while you are focusing your time on your digital reputation, where are you finding the time to manage your investment portfolio?

The other reason is that we live in a digital age. Things are not quite as black and white and they are starting to blur together in shades of gray (or shades of multi-color and rainbows). This is a phenomenal thing and a wonderful age in which we live, but if we are not careful, we can step into a “pretty” quagmire of color that isn’t so pretty once our feet hit the bottom of the “puddle.”

So, focus on the ROI (return on investment) of your social economics, your socialnomics, as Mr. Qualman teaches. While you are doing that, take a look at how the money side, that green stuff, is doing and how you can manage it with the wonderful technology that is available to us in this digital age, without losing your shirt in the process.

“If you fail to plan, you plan to fail.” – Benjamin Franklin

Planning for your financial future is necessary if you give a hoot on how your finances finish the race. Another way to put that is that if you want to have a little more control over your financial outcome, then planning should come up on that list of things to do.

If we are honest with ourselves, we all know we should be working on that financial planning part of our life, but many of us resist taking action. The idea of going to a bank and discussing financial resources seems cumbersome (and sometimes uncomfortable). Fortunately, there may be a better way and that is what we are discussing today.

The Robo Advisor

That is, the use of what is called a robo advisor. It sounds like something from the future, but it’s a real life financial advisor who can manage your portfolios online with minimal human interaction.

Investopedia defines a robo advisor this way: “Instead of doing your own research or paying high fees for a money manager, such services allow investors to deposit funds and allow an algorithm to take care of it all.”

Incidentally, as a side note… In the same way that some companies refer to “financial advisors” and some refer to “financial advisers” (the difference between the “-ors” and the “-ers”), robo advisor can also be spelled both ways. For our purposes, we are using the “-ors” spelling.

There are several advantages to using a robo advisor. We can think of a few advantages (over not using one) and have listed those in this article. But, first, a handy article that actually ranks the firms that offer the services of robo advisors and lets you enter some of your own information (or what you would like to be your own information) into a sort of calculator that helps you to choose which robo advisor is the best for you and your situation, based on their designated ranking criteria.

So Many From Which to Choose!

This tool and article ranks the robo advisors in a way that helps to determine the best robo advisors on the web. The criteria that is used includes:

| Rating | Year founded | Number of users | Tax loss harvesting |

| Minimum initial deposit amount | Number of portfolios | Assets under management | Single stock diversification |

| Fractional shares | Human advisors | Direct indexing | Taxable accounts |

| 401k plans | IRA accounts | Roth IRA accounts | SEP IRA accounts |

| Trust accounts | 529 plan accounts |

This list of criteria gives you a bit of an idea of some of the criteria that you should be considering when choosing your robo advisor, even if you are not using this handy tool. It also helps you to start to decipher the advantages that may be waiting for you if you choose the robo advisor route over the traditional route.

24/7 Access

As we started this article, talking about technology and all of the wonderful things that are available to us, as a result of technology, one that stands out is the 24/7 access. This is true of shopping at amazon.com, other stores, accessing our bank account, and in the case of robo advisors, accessing that, too!

Since using the Internet is already familiar, it is not likely that there is a huge learning curve to understanding how to use any tools that you would need to work with a robo advisor. It may mean learning how to use a private messenger program, but if you have ever used Facebook PM or any other PM or IM (private message or instant message) service, you are all set. Add to that, the email program and you know how to communicate on the Internet.

Robo advisors use the technology you’re already familiar with to bring your strategy for your investment portfolio to the forefront. You’ll be able to check in with your robo advisor outside traditional operating hours, and you’ll have a record of all communications.

In addition to convenience, robo advisor platforms put easy-to-use tools in your hands. You can check out investment and financial planning calculators, or read up on the latest financial trends. You’ll begin to see that finance can be fun. Another advantage is that as you learn more about the financial industry, you will feel like you have the handle on your finances and that is simply a “feel good” place to be, in your management of your investment portfolio.

You can watch your money grow around the clock. There’s no need to call your financial advisor to check on your portfolio. Robo advisors provide instant access to the details of your account. This exciting feature can help you stay on top of financial trends and make sure you have access to the best performing stocks right when you need it — instantaneously.

The Price Advantage

With traditional financial advisors, there is a lot of overhead with the office, the office furniture, the office expenses, the utilities, etc. What isn’t always evident (but I know from first-hand experience), is the wining and dining element and ensuring that the right image is upheld (especially in the Beverly Hills high net worth financial services arena).

The advantage, when dealing with robo advisors, is that you don’t have to pay for all of that. Therefore, the prices savings is passed down to you and you pay lower fees. Once your fees are lowered, there is a higher percentage of the monies that are combing back into your wallet!

To Use a Robo Advisor or Not to Use a Robo Advisor

There are pros and cons to choosing to use a robo advisor. It isn’t really a decision that you should make with a flip of a coin. There are those experts who swear by the use of a robo advisor and there are those who may claim that it is a mistake.

For example, according to the Huffington Post, you should use a robo advisor because there are lower fees, it is convenient, there are low minimums, it is as safe as a bank, and there is access to financial planning tools and services. Some of these reasons are the same as what we listed, as well. Even with that, if we were to play devil’s advocate we may ask whether the fees really are lower, just how convenient it is, are the minimums low enough, is it truly safe on all fronts, and are the tools and services worth the access?

There are also less obvious concerns that most people may not realize and that is where the article “5 Reasons Most Robo Advisors are Not, in Fact, Advisors” from ThinkAdvisor, comes in handy. Playing devil’s advocate on that one, in support of robo advisors, would be a question of “Did we truly think they were the same as the traditional human advisor?” What this comes down to, on some levels is a matter of managing expectations, but it also includes being informed.

In Conclusion

Robo advisors are the way of the financial future. These highly credentialed financial advisors love their jobs and their ability to work remotely. You may find that you’ll love that robo advisors cost less and get the same results as traditional financial advisors. And, they’re not robots – they’re real live people.