Fraud Detection with Machine Learning: Securing Your FinTech App

Unfortunately, fraud remains a common threat in the digital finance field. Ensuring the security of financial transactions is paramount as this enables you to create a trustworthy FinTech solution. Fraud detection and prevention are definitely not a matter of choice, but protection is needed to safeguard credibility and accommodate a strong background for your app.

At the core of this defense is an anti-fraud system designed with the utmost care to identify the slightest potential fraud and keep the integrity of digital transactions from being tarnished. You should be aware of the fact that fraud methods are constantly evolving, so you’ll need to be always a step ahead in terms of security.

To aid you in this, this post will disclose what exactly is considered financial fraud, how anti-fraud systems work, what the role of machine learning in fraud detection, and how to use it properly.

What Is Financial Fraud?

Financial fraud ranges from sophisticated schemes that target institutions to fundamental transactions that defraud entities. Technological advancements have increased the escalation of fraud, especially in online transactions such as credit card fraud.

Over time, fraud has changed alongside financial systems. Anyway, fighting fraud in e-commerce and online banking is vital. There is a simple rule – if you do not make enough effort regarding the security of your FinTech app this results in a loss in your services’ value and trust.

How Anti-Fraud Systems Work

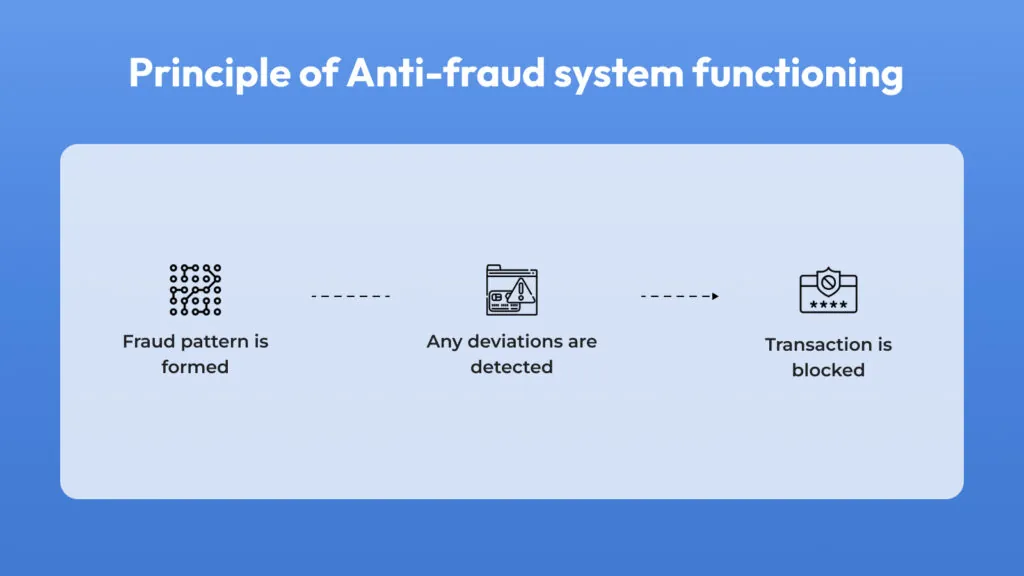

Anti-fraud machine learning systems work by analyzing normal transactions to understand typical behavior patterns. These systems can be unsupervised, supervised, or semi-supervised and they continuously adapt to spot any unusual activity that might indicate fraud.

If an anomaly were to point to anything that was assumed or warned to be potentially fraudulent, the system would flag it for identification during a review while trying to decrease as much as possible the false positive results that are known to hurt everyday transactions.

E-commerce fraud detection effectively prevents illegal transactions and provides a comfortable user experience. It helps to create trust among customers and compliance, especially in financial domains. It promptly identifies and raises an alert on any suspicious activities.

Some of the benefits of anti-fraud machine learning systems are effective in detecting inconspicuous fraudulent behavior and managing large data sets. It should be of a complexity level that imitates the human brain to outdo the standard human capabilities in both precision and speed.

Machine Learning Integrated with Fraud Detection

Machine learning is important for detecting fraud using advanced algorithms especially if you’re thinking about how to make a banking app on your own. The Random Forest algorithm, capable of complex relationships between data, identifies suspicious transactions by evaluating vast datasets. Neural networks, being very close to the human brain, are excellent at identifying complex fraud patterns along with a cohesive approach to machine learning.

Some of the most utilized techniques include Support Vector Machines and K-Nearest Neighbors. Apart from this, Reinforcement Learning algorithms allow these systems to learn and adapt to users’ behavioral patterns, qualitatively balancing preventing fraud and processing usual transactions.

Why Use Machine Learning for Fraud Detection?

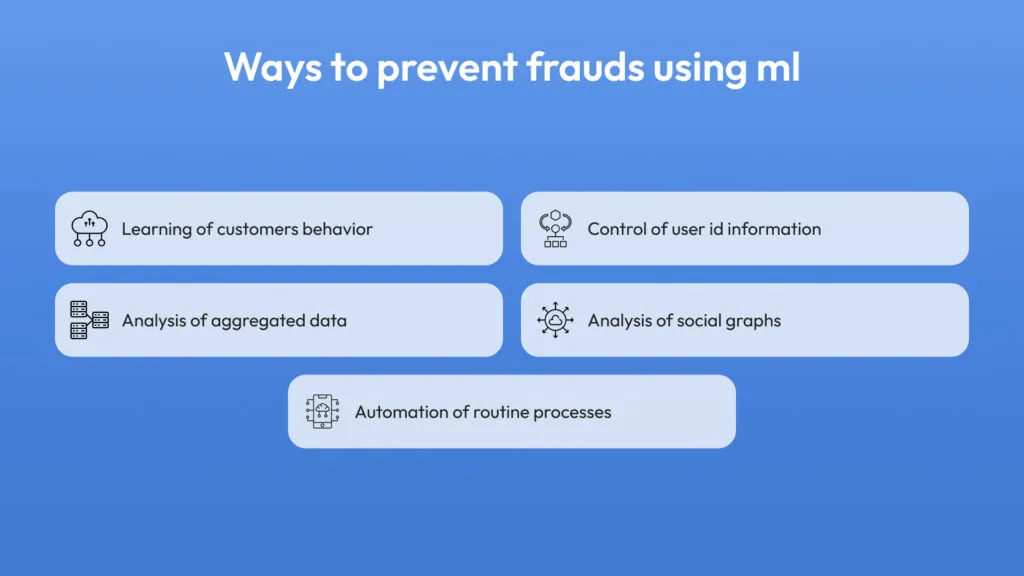

The following aspects are the exact ways machine learning helps businesses to conduct thorough fraud detection:

- Login activity monitoring: Machine learning algorithms are superior in spotting suspicious login attempts or logins from unfamiliar locations, which can indicate potential fraud attempts.

- Customer behavior analysis: Machine learning models can effectively identify instances of friendly fraud based on a customer’s purchase history, return rate, and chargeback frequency.

- Invoice processing oversight: Machine learning is utilized to review the invoices and check for discrepancies that could point to fraud, such as double invoicing or mismatched figures.

- Loyalty program safeguard: By using machine learning, tracking in loyalty programs detects any anomaly in accumulating points or patterns of activities regarding redemptions to make sure transactions are accurate.

- Two-in-one operations: it keeps fraudsters at arm’s length and cultivates trust between a business and its customers. As these systems progress with time, they will separate actual fraud patterns from day-to-day customer behavior, giving strong protection from financial crime.

Conclusion

Machine learning is a sure aid in countering fraud. It functions through vast datasets within a minimum time to detect patterns otherwise impossible to be detected by humans. Algorithms like Random Forest do not overfit, so the results of pinpointing the fraud transaction are more accurate than ever.

Financial institutions run different algorithms, mainly K-Nearest Neighbors and Logistic Regression, to distinguish normal versus abnormal activities with minimum false positives. Therefore, to do it well, to protect against such a high level of online fraud, e-commerce, and finance have to constantly fine-tune their defenses and keep the algorithms fresh with ongoing analytics. Machine intelligence is the vigilance that guards the financial integrity of this digital age.