What is Bitcoin CFD Trading?

Do you want to learn about Bitcoin CFD trading? This article explains crypto CFD trading and how to do it.

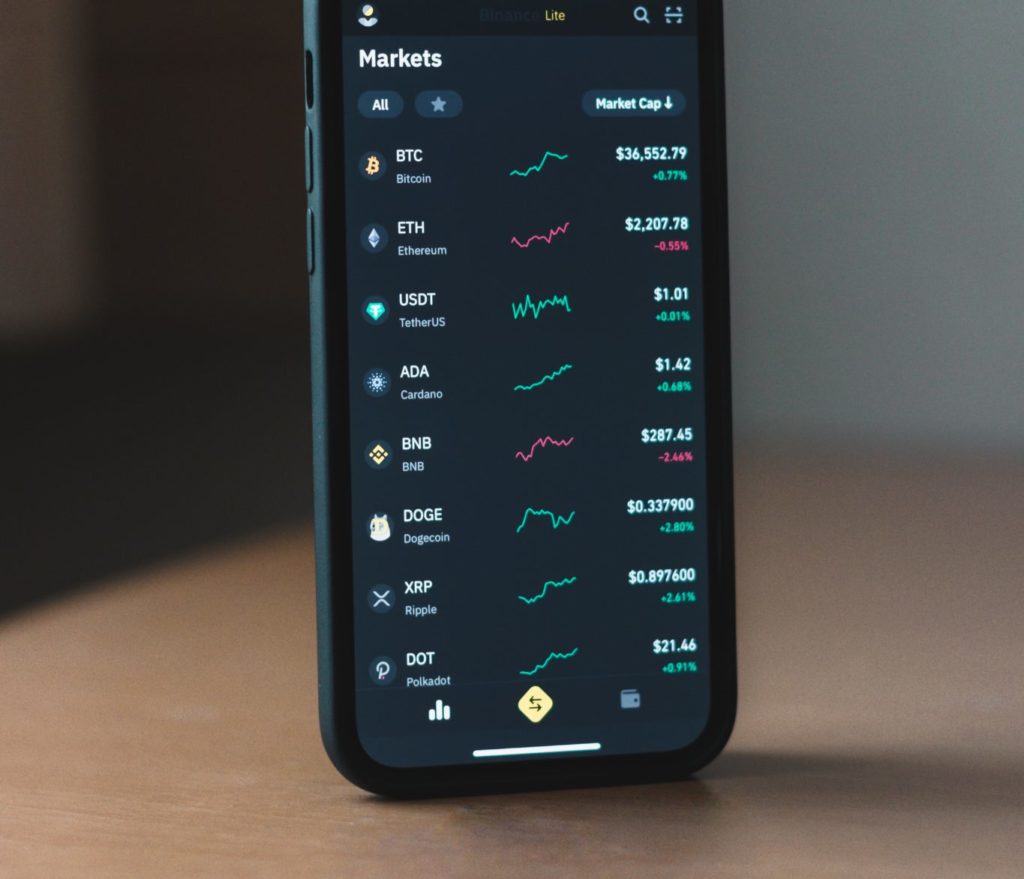

Bitcoin CFD trading is a technique that allows you to invest in or trade this crypto asset by participating in a contract between you and a broker rather than opening a trade position directly on the market. Being a trader, you agree with the broker to replicate specific market conditions and settle the difference upon the closure of the trade position. Most people trade Bitcoin on platforms like https://bitcoin-prime.app/. You register and load your account with fiat money to start purchasing Bitcoin.

However, Bitcoin CDF trading has numerous advantages you may not enjoy when trading directly. For instance, you can access global markets, take short positions, and leverage your trading. Traditionally, you may not enjoy such benefits.

Understanding How Bitcoin CFD Trading Works

When you open a position on a digital CFD platform, you don’t own Bitcoin. You only speculate on the asset’s price movement and settle the difference when the trade position closes. And you can take a long or short trade position when trading Bitcoin CFDs.

A long position implies that you anticipate an increase in Bitcoin’s value so that you can buy it at a lower price and sell it later at a higher price to make a profit. On the other hand, a short position predicts that Bitcoin’s value will drop, so you can sell it now at a higher price and buy back when the prices have dipped.

Leverage is also possible when trading Bitcoin CFDs. It implies that you can open a position using only a fraction of the total value. For instance, if you’re trading with 5:1 leverage, you only need $20 to open a $100 position. The broker covers the rest.

Ways You Can Trade Bitcoin CFDs

You can trade Bitcoin in numerous ways, and each has unique benefits. Here are techniques you can use to purchase and sell this digital asset.

Brokerage Firms

You can go through online brokerages to trade Bitcoin CFDs or any other asset. The advantage of this approach is that it’s straightforward since most platforms have a user-friendly interface. Also, these firms provide essential resources you may need as a beginner, such as market research and analysis.

However, be careful when selecting a broker since some are not transparent. Others have high fees that may erode your profits.

Crypto Exchanges

Here, you directly trade with other market participants through a decentralized platform. The advantage is that the process is more transparent since you control your trades. Also, these platforms don’t charge high commissions.

Conversely, exchanges are complex for beginners, and you may need time to master how they work. Besides, they’re often prone to hacking incidents, which may result in losses.

Contract For Difference

A contract for difference is between you and a broker where you agree to replicate market conditions. The advantage is that it’s straightforward, and you can trade Bitcoin with leverage. Also, most CFD providers are regulated, adding an extra protection layer. On the downside, you don’t own the asset when trading through this method. Also, some brokers may be scammers, so you need to be careful when selecting one.

Parting Shot

Bitcoin CFD trading is a great way to invest in or trade this crypto asset. It allows you to take advantage of numerous benefits, such as leverage, accessibility to global markets, and short positions. However, select a broker or exchange carefully since some need to be more transparent. Also, understand how these platforms work before you start trading.

This article has been published in accordance with Socialnomics’ disclosure policy.