Crude Oil Trading: How to Gain an Edge Over the Market?

Crude oil is among the best commodities on which to trade future contracts. The crude oil market is active and is well known around the world. Prices of oil fluctuate with the slightest news about prices, which makes it a favorite swing for day traders looking for an edge.

The volatile crude oil trading environment provides solid opportunities for trading, for both day traders and long-term traders. However, you may lose a lot of money if you’re on the wrong side of price movements. To avoid this, you should first understand crude oil trading tips and what causes oil price movements.

Moreover, crude oil is among the most actively traded commodities today. Oil’s price affects the price of many other commodities, including natural gas and gasoline. Nonetheless, the ripple effect of crude oil prices has a significant impact on stocks, bonds and currencies prices around the world.

Below, we look at factors that affect the price of crude oil, why you should be involved in crude oil trading, and tips to make a consistent profit.

Why Engage in Crude Oil Trading?

Crude oil is the world’s primary source of energy and this has made it a very popular trading commodity. Crude oil is a naturally occurring fossil fuel and can be refined into different products including wax, lubricants, gasoline, and diesel. Additionally, crude oil is on high demand, traded in large volumes and extremely liquid. As such, crude oil trading involves high volatility, clear chart patterns, and tight spreads.

Factors That Affect Oil Price Movements

Crude oil trading involves two major focal points including supply and demand. Many factors affect the price of crude oil such as news involving geopolitics, tensions in the Middle East or the spread of a new virus impact the price of oil but what should be mainly considered are supply and demand.

Supply Factors

- War in the Middle East creates huge concern about the supply of oil. For instance, the civil war that took place in Libya in 2011 led to a 25% increase in oil prices. Also, the maintenance of major oil refineries significantly affects the supply of oil, thus affecting its price.

- OPEC (Organization of the Petroleum Exporting Countries) production cuts or extensions significantly affect oil prices. For instance, in 2016, when this organization announced its decision to reduce global oil supply by 1.9%, the price increase from $44/bbl to $80bbl.

Demand Factors

- Oil Consumers: the largest oil consumers have been countries such as the United States and Europe. However, there has recently been a significant surge in oil consumption in countries such as China and Japan. Traders should pay attention to such developments, as well as their economic performance. Any changes in consumption may have a significant impact on demand thus prices.

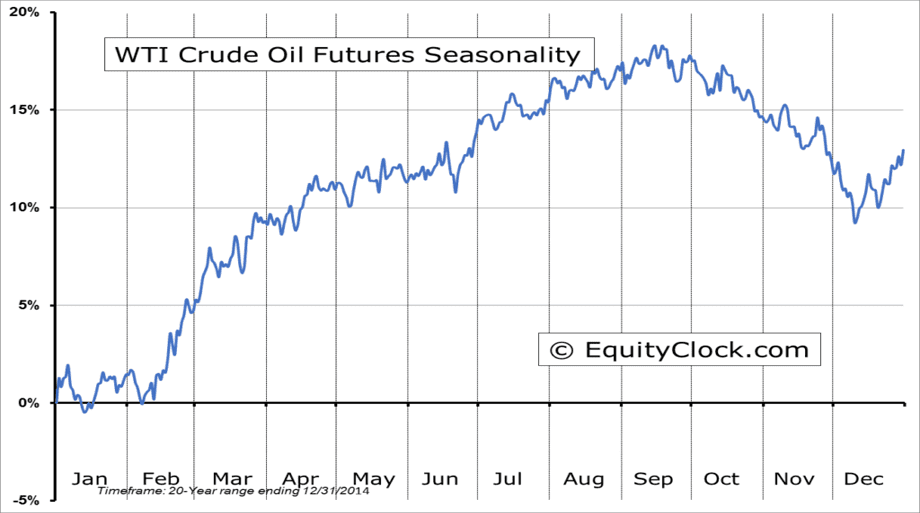

- Seasonality: For instance, during hot summers, people travel a lot and there is an increase in activities in general. This leads to an increase of oil consumption. During cold winters, people use oil products to heat their houses, which also leads to a surge in oil consumption.

Tips to Make Consistent Profit in Crude Oil Trading

Traders often fail to take full advantage of oil price fluctuations, either because they do not understand the unique characteristics of this market or are unaware of changes and their effects on the price of oil. Below are tips to help you understand the market better and take full advantage to make a significant profit in crude oil trading:

- As discussed above, the price of crude oil is determined by supply and demand factors. Oversupply of crude oil may lead to a reduction in prices. Rising demand often leads to increased oil prices.

- Understanding the crowd is another important factor that will enable you to make profits. In this market, there are different players, including professional traders and hedgers, industry players, and hedge funds. The first group dominates these markets, the second group takes positions to offset exposure, while the last group speculates long and short price directions. Most people are retail traders and investors. This group has a less significant influence. However, their influence is felt during sharp oil price surge, which attracts capital from them. Moreover, most small traders make decisions based on emotions and headlines from relevant news articles.

- The choice between Brent and WTI crude oil: WTI (West Texas Intermediate Crude) and Brent are the main markets for crude oil trading. Initially, pricing between these markets remained within a narrow band for many years, but this ended in 2010, when both markets made sharp changes due to changing supply versus demand environment.

Conclusion

Crude oil trading requires exceptional skills and a comprehensive understanding of the energy markets. Traders mainly need to understand what moves the commodity, the supply and demand factors, and exercise a great amount of discipline due to a large number of sharks in the market that always want to take their money.

This article has been published in accordance with Socialnomics’s disclosure policy.