AI in FinTech: Transforming Digital Banking

The FinTech landscape is undergoing a seismic transformation driven by the extraordinary capabilities of Аrtificial Intelligence (AI). The AI technological revolution will profoundly change how the industry operates. AI in FinTech allows us to elevate our customer service and fine-tune our risk assessment procedures, leading to highly personalized and efficient services. In this article, we will look at the critical issues AI addresses in the financial services industry. You will also learn about groundbreaking FinTech startups utilizing AI, and the exciting potential AI holds for the future of financial software.

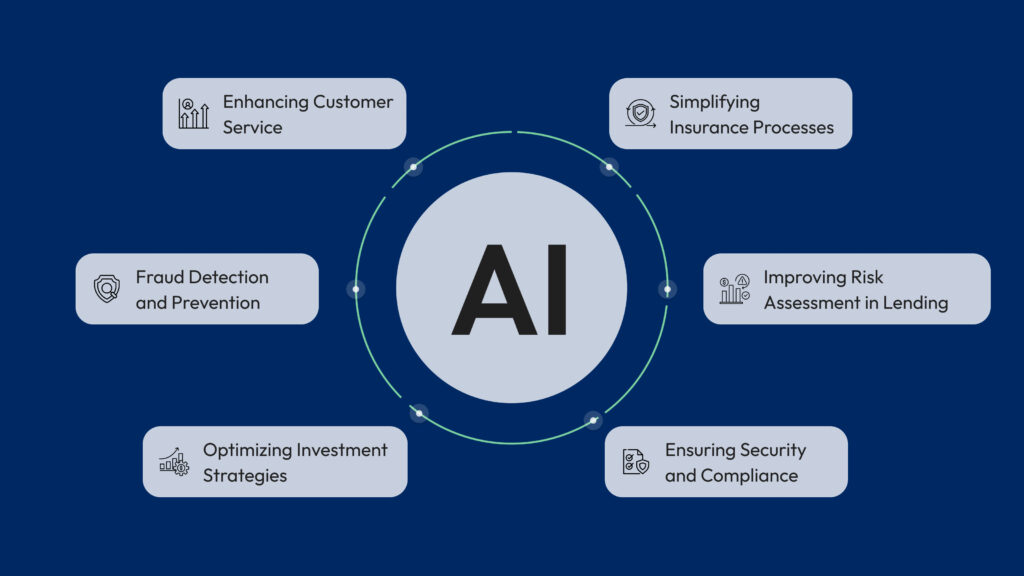

Key Financial Challenges Solved by AI in FinTech

Using AI in FinTech is not just an enabler — it is part of the most important strategic development. A lot of challenges are placed on financial institutions, ranging from delivering the best customer service to maintaining safety while assessing transactions and accurately weighing risks. AI gives a new shot of innovation and transformation like never before in the history of FinTech companies.

Elevating Customer Support

Customer service makes or breaks a company. Meet the revolutionary implementation in customer service: AI-driven chatbots and virtual assistants. A set of unparalleled, quick ways to respond to customers’ queries can be enabled by natural language processing and machine learning technologies. They provide answers to questions and give personal interaction, coming very close to human support.

Further, clients can access AI 24/7 to receive help whenever needed. Prompt resolution of problems, together with deeper insights into client preferences, is where AI revolutionizes financial customer service, setting benchmarks for satisfaction and dependability.

Predicting and Preventing Fraud

While fraud remains a critical threat to financial institutions, the rise of AI in FinTech is helping redefine how we have been going about this challenge. AI systems really help detect any suspicious patterns or anomalies in huge amounts of transaction data, a possible sign of fraudulent behavior. With such early warnings, institutions can intervene more quickly and prevent potential fraud due to these sophisticated algorithms.

The most important feature of AI that sets it apart is dynamic learning. As fraudsters evolve and sharpen their strategies, AI systems improve and continuously update their methods of detection. In this sense, adaptation to change is key to keeping abreast of the game, with developed methods of protection against potential financial loss. At this stage of very active defense, AI provides an essential tool in strengthening defense against deceptive schemes.

Improving Risk Assessment in Lending

Traditional methods of appraising lending risk often come up short in capturing the full view of an applicant’s creditworthiness. AI-powered credit scoring systems are game changers because of their predictive analytics capability. Unlike conventional methods, these advanced systems rely on a more diverse array of data — unconventional sources included — to bring a nuanced assessment of financial behavior. It further expands the horizon for lenders to make more efficient decisions. As a result, it leads to lower rates of default and improves the performance of loans. AI-driven systems enable thorough risk assessments, promoting not only more sustainable lending but also benefiting both lenders and borrowers.

Simplified Insurance Solutions

The insurance industry also shifts toward Artificial Intelligence to rethink underwriting and claims management. AI algorithms work out the differences in risk very precisely, hence helping structure the best-fit insurance plans for an individual’s specific needs. More than that, it makes these insurance products relevant so that customer satisfaction is sharply enhanced.

AI also verifies information by running data and analyzing it at immense speed during the claims processing cycle. It sifts valid claims from fraudulent ones with much efficacy, thus reducing time wastage and increasing operational efficiency. This indeed streamlines the entire process for faster resolutions and a superior experience for customers.

Better Evaluation of Investment Opportunities

AI’s influence on market-trend analysis is changing the rules of the game in the field of investment strategies. With sophisticated algorithms, it scours through volumes of market data to dig out patterns and trends that would probably have eluded human analysts. This deep analysis allows automated trading systems to make a better-informed and strategic choice. It is not just about making better trading decisions — understanding how to build an investment platform that effectively leverages AI-driven insights is also becoming crucial. Through the use of sophisticated algorithms, AI burrows into massive amounts of market data to dig out patterns and trends that probably would elude human analysts.

This is what makes artificial intelligence so special: the way it continuously follows up and adjusts to the continuous changes in market conditions gives the investor a palpable competitive advantage. Armed with such insights, investors can make better decisions toward improved portfolio management that will lead to superior investment results and, ultimately, continued success.

The Promising Future of AI in FinTech

Artificial intelligence has reformed financial software and charted an innovative path for the future, with increased efficiency, high security, and groundbreaking innovation. Let’s discuss what to expect from the event:

Smarter Decision-Making

A financial institution could leverage AI technology to spot patterns and trends from huge pools of data even more effectively. These capabilities would lead to more precise market forecasts and definitions of investment strategies.

Made Simple Automation

AI in FinTech minimizes the risk of human errors and creates more time for actual planning and decision-making. Some advanced tools include chatbots and robotic process automation that rebuild operations and customer service by providing enhancements.

Personalized Security Measures

Fraud detection reaches the next level with AI by constantly analyzing transaction patterns for anomalies. Therefore, with the continually emerging threats, it is necessary to be adaptive in order to keep sensitive financial information safe.

Customized Services

AI operationalizes the use of individual customer data to drive tailored financial advice and recommendations. It increases client satisfaction and engagement through personalization.

Simplified Compliance

AI automated compliance monitoring will enable institutions to navigate complex regulations easily. So, you get an opportunity to stay within the law with the least penalties possible and follow the evolving legal requirements more reliably.

Wrapping Up

To sum it up, AI is revolutionizing the world of FinTech. The technology deals with critical challenges and opens up new levels of productivity and creativity for the industry. It powers customer support, fraud detection, risk assessment, operations in insurance, and optimization of investment operations. An evolution of AI in FinTech will make disruption in financial services much bigger: more personalized, secure, and automated. On the other side, everything is not so perfect. If financial institutions don’t adapt to these advances, they will lose competitiveness and not satisfy clients’ dynamic demands.