Why Bitcoin is the Future of Money

Bitcoin has grown from a computer scientists’ movement to a mainstream phenomenon with an ethos and a blueprint within a short lifespan. The growth of this cryptocurrency may eventually inspire the redesign of the financial system, the internet, and known as people know it today.

This virtual currency is the first of its kind. Apart from creating trustless internet money, Bitcoin has led to a movement aimed at decentralizing financial services. Satoshi Nakamoto published a Bitcoin whitepaper back in 2008 before launching this virtual currency in 2009. That’s when the Genesis Block emerged.

This whitepaper created the digital currency that people know today. And it operates in a trustless and decentralized way to allow users to exchange monetary value via the internet without involving financial intermediaries.

The Digital Age Money

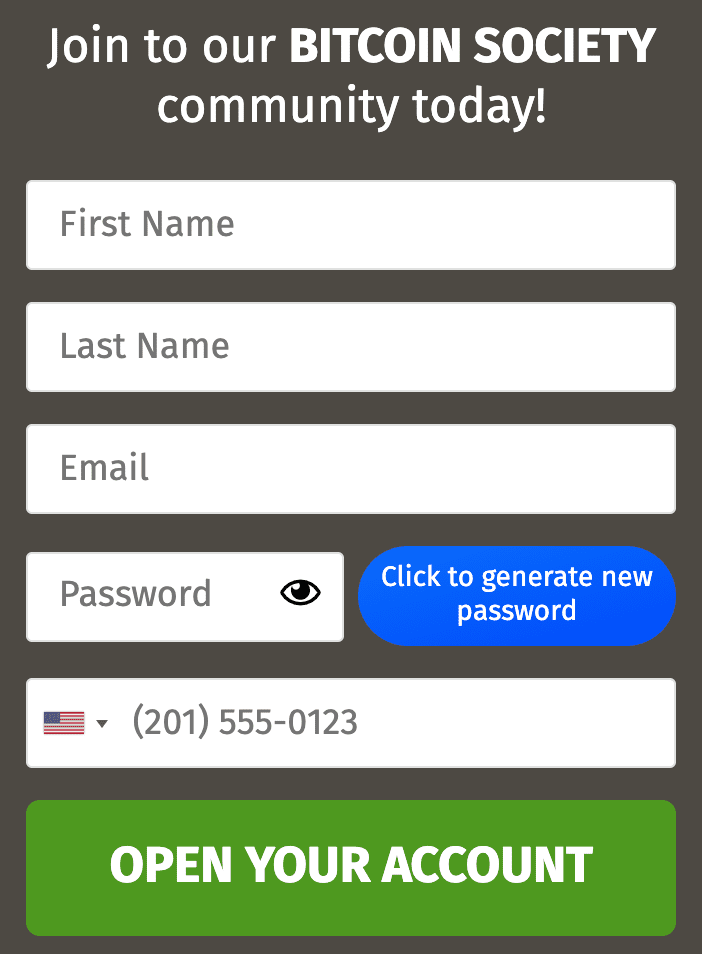

Bitcoin is a value representation. That means it’s not a digital or physical object. The cryptocurrency is available as a form of ownership record on the blockchain. When people use platforms like The Crypto Genius to purchase and sell Bitcoin, they exchange value rather than a digital or physical object. Perhaps, you can register with this app by clicking the image given below.

But to understand Bitcoin’s ownership record, you should understand the Bitcoin network first. And this network comprises three things.

- Bitcoin transactions: A Bitcoin transaction is a financial transaction. It’s value transfer from one entity to another. However, a Bitcoin transaction doesn’t involve a financial service provider like a bank. Instead, blockchain technology provides the nodes that record, validate, and secure the transaction within the Bitcoin network. And this process enhances the security and verification of Bitcoin transactions.

- Bitcoin blockchain: Bitcoin blockchain refers to the public record with unique attributes for enhancing trustworthiness and security. Many computers in the blockchain networks store this public record, and nodes update it simultaneously and in real-time. What’s more, no entity controls the nodes, and this makes Bitcoin decentralized.

- Nodes: Nodes in the Bitcoin network broadcast all transactions. The nodes ensure the validity of Bitcoin transactions. That means these nodes scan the blockchain before confirming that somebody has sent the money they have in their wallet and authorized the transaction.

The Bitcoin network organizes valid transactions after 10 minutes. And blockchain technology broadcasts the information about every block to the whole network. Bitcoin mining involves solving computationally intensive puzzles. Whenever a miner or a node solves a problem, the network awards them a pre-determined amount of new Bitcoins. And this is called a Block Reward.

Empowering Individuals and Revolutionizing Finance

Satoshi Nakamoto developed a new method for securing transactions using a democratic and decentralized network during the 2007-2008 financial crisis. This crisis rose from questionable lending practices that banks adopted and their risk-taking activities. Even after engaging in such activities, governments gave these banks bailouts. And this led to the lack of trust and confidence in the financial system globally and widespread protests.

Bitcoin provides an alternative to the financial system’s weakness. This cryptocurrency has shown that decentralization is possible within the financial sector. What’s more, it shows that a monetary system that empowers the users is achievable. In its nature, Bitcoin takes control from a few entities and gives it to many. That’s why Bitcoin has achieved an impressive acceptance over the time it’s been around.

Essentially, this virtual currency fosters independence while providing opportunities for all. This digital currency compares to inventions like the personal computer and printing press. And that means it’s a big deal.

Final Thoughts

Bitcoin is an innovation that is likely to transform how people see and use money. With its increasing acceptance and adoption, Bitcoin could be the future of money.

This article has been published in accordance with Socialnomics’ disclosure policy.